Trust is the basis of my work

Our work together can be high-quality, but only if we trust each other.

Relationships between tax advisors and clients should be based on mutual trust and a complete understanding of the client’s situation. Professional advice can then be given in a most effective and relevant way.

The key is good communication. We must understand each other clearly! Responding to my clients’ wishes is very important to me. I develop an overview of your situation, then decide on my consulting approach.

Trust is the basis of my work

Our work together can be high-quality, but only if we trust each other.

Relationships between tax advisors and clients should be based on mutual trust and a complete understanding of the client’s situation. Professional advice can then be given in a most effective and relevant way.

The key is good communication. We must understand each other clearly! Responding to my clients’ wishes is very important to me. I develop an overview of your situation, then decide on my consulting approach.

Services

I offer you the full range of tax and business consulting services, from accounting and payroll management to international tax law. My clientele includes both private individuals and sole proprietorships, as well as partnerships and corporations from various industries.

Get to know my services in more detail here:

Annual financial statements

Annual financial statements represent the closing of a fiscal year, and include a calculation of profit and loss. The counterpart for freelance (self-employed) professionals and for small businesses is called “excess revenue statement“. It serves the same purpose.

The balance – the comparison of assets and liabilities on the balance sheet date – is a key component of financial statements. Deadlines are adjusted by type of company and can range from three to twelve months.

Annual financial statements are among the most important documents for you as a business, because they contain all the ‘bare’ facts of your company: balance sheet, profit, loss – all this and much more is shown on this statement.

our job is to provide me with the necessary documents. I transform the numbers from your accounting records (and other data) into a ’round’ package.

Financial analysis and consulting

Financial analysis

I will help you define your business objectives and support you in developing and controlling your business and financial plans. I’ll also help you develop your essential data regarding job-order costing (order calculation). Do you know what your fixed costs are, or how long liquidity can be maintained when a key client delays payment? I also organize the documents requested by your bank. I then advise you how you can receive a good “rating” (and the benefits of favorable interest rates).

Don’t accept errors. Get solid advice so you can avoid costly mistakes! Die Finanzbuchhaltung ist vor allem aber die Basis für Ihre betriebswirtschaftlichen Auswertungen. Die Finanzbuchhaltung ist vor allem aber die Basis für Ihre betriebswirtschaftlichen Auswertungen.

Lohnbuchführung

Mit der Lohnbuchführung werden Lohn- und Gehaltsabrechnungen für Ihre Mittarbeiterinnen und Mitarbeiter sowie die Lohnkonten und zugleich die erforderlichen Anmeldungen und Beitragsnachweise erstellt und Datenübermittlungen an die entsprechenden Stellen vorgenommen.

Income tax return

“Income tax liability begins with the completion of childbirth”

Anyone who is domiciled or habitually resident in Germany is subject to unlimited income tax on his or her total income and, with a few exceptions, is obliged to file an annual income tax return in Germany. The world income principle applies.

Unfortunately, the income tax return still does not fit on a coaster – although this has long been promised to us by politicians.

II will help you classify your income by income type, checking whether it’s taxable or tax-free, then classifying it according to the seven types of income that the Income Tax Act recognises. We take into account business expenses and income-related expenses as well as special expenses and other deductions, and determine the correct income tax together with any solidarity surcharge and church tax.

Income tax is a tax that only applies to income and, in some cases, to the development of assets. To the extent that tax planning and optimisation is possible, I will gladly help you.

With an expertly prepared income tax return, you will find out at the earliest possible point in time which tax payments are due to you.

Business tax returns

A corporation tax return must be prepared for “non-natural persons” such as a GmbH or AG.

. The basis for trade tax, which is a municipal tax, is the profit according to the Income Tax Act. In the trade tax return, the additions and deductions regulated by the Trade Tax Act are made to determine the so-called trade tax base amount. This amount is multiplied by the municipalities via the trade tax measurement amount valid there. In this way, trade tax is calculated.

The VAT declaration is also part of the company’s tax returns. Value Added Tax is levied on the supplies and services provided by a company in Germany against payments within the framework of the company. The annual declaration explains the sales generated in a calendar year.

Advice on tax audits

I disagree if an examiner wishes to make unauthorized changes. I will see to it that the possibilities provided in the tax code are exploited to the full for you. I relieve you by providing my office for examinations.

You are not left alone with the examiner. And the time and effort you need for this is considerably reduced.

Financial accounting and payroll accounting.

Financial accounting records income and expenses between the company and the outside world. This documents the changes in assets and liabilities.

Tax liabilities are then calculated on the basis of the results of financial accounting.

Together, we work out the distribution of tasks and define which tasks are to be carried out by the client and which are to be carried out by my office.

However, above all, financial accounting is the basis for your business evaluations. Payroll accounting is used to prepare payroll and salary statements for your employees and, at the same time, to prepare the necessary declarations and contribution statements, and to transmit data to the relevant departments.

International tax law

Germany has finalised double taxation agreements – DTAs for short – with many countries in the world. These agreements are designed to avoid double taxation of the same income in different countries. Germany has negotiated separately with each of the countries where such an agreement exists.

This is the reason why many agreements are at first glance similar, but come to different details and therefore different solutions.

I will gladly help you to check the corresponding DTA(s) for your income from abroad and work out which country has the right of taxation, and which method should be used to avoid double taxation in your case.

Taxation of pensions

The newly starting statutory pensions will be fully subject to income tax until 2040. The taxable portion of the new pension increases in annual steps of 1-2%.

The basis for determining the tax-exempt portion is always the starting year of the pension. The tax-exempt amount that was determined once is valid for the term of the pension.

The large group of private pensions are only taxed on the so-called income share. In individual cases, full taxation may also apply. In this case, it is necessary to examine exactly which model was used to build up the pension system. The tax assessment is supported by a certificate from the pension office defining the taxable parts of the pension.

Pension recipients who do not file an income tax return are increasingly being prosecuted as tax evaders.

Auch wenn Sie meinen, dass eine Einkommensteuererklärung für Sie gar nicht in Frage kommen kann, sollten Sie doch vorsorglich alle Belege (insbesondere Arzt- Apothekerkosten) aufbewahren, damit diese Aufwendungen steuerlich nicht verloren gehen.

Ich helfe Ihnen bei der Ermittlung des einkommensteuerpflichtigen Rententeils und errechne die fällige Einkommensteuer. Soweit eine Steuer von EUR 0,00 entsteht beantrage ich für Sie die Befreiung von der Abgabe der Einkommensteuererklärung.

Company

Tax consultant Petra Sabrowski is supported by a team of service-oriented employees who have been working in the field of accounting and taxation for many years. Through continuous training and education, our team stays up to date both technically and in terms of tax knowledge.

In addition to professional qualifications, a personal and friendly approach to our clients is a given for us.

The decisive factor for the quality of our work is a good working atmosphere. Only in an environment characterized by appreciation and mutual respect can we achieve the best possible results for you.

Petra Christine Sabrowski

Tax consultant

I have been working in the tax consulting profession for almost 35 years. I started as a trained tax clerk and continued my education to become a certified accountant. Then came my two daughters – they were my priority for a while.

However, the desire for more remained. So, in the fall of 2005, I began my training to become a tax consultant.

In January 2007, I successfully passed the final part of the exams in Hamburg. Since March 1, 2007, I have run my own tax consulting firm.

Service

Here you’ll find information about our services, downloadable forms and articles on the subject of taxes.

Forms to Download (in German only)

Tips, suggestions and fact sheets (in German only)

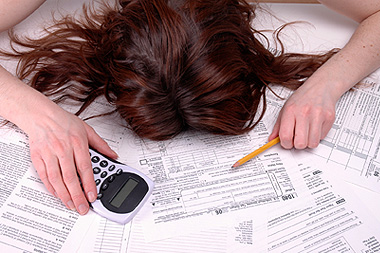

The “Tax jungle”

Are unsorted receipts and invoices piling up on your desk? Do you get a racing heart when opening mail from the tax office?

Do you feel intimidated by terms like “Uniform and Separate Determination of Profit Declaration” or “Digital Tax Audit”?

If you, too, suffer from chronic “procrastination” when it comes to taxes, I will help you overcome that inner resistance and finally get started. Let my enthusiasm for the work inspire you. You’ll quickly realize that the supposedly unpleasant tasks aren’t that bad at all, as they serve a more than worthy cause: to integrate more relaxation and ease into your workday.

If you, too, suffer from chronic “procrastination” when it comes to taxes, I will help you overcome that inner resistance and finally get started. Let my enthusiasm for the work inspire you. You’ll quickly realize that the supposedly unpleasant tasks aren’t that bad at all, as they serve a more than worthy cause: to integrate more relaxation and ease into your workday.

Even though we have the most complex tax system in the world, the people at the tax office brew their coffee with the same water as you do.

I approach my tasks with great joy and fun, and I love working with a wide variety of people. This ability ensures that my clients feel well cared for. I show you that taxes can be fun and that the results of my work are not just for the tax office, but also provide support in everyday life.

I warmly invite you to get to know me and my office.

Contact

Petra Chr.Sabrowski

2.Stock

21502 Geesthacht

Free parking in front of the office

Entrance at the corner of Steinstraße & Elbstraße